You can look to any number of statistics to gauge the health and future of the paddlesports industry, but the biggest factor may be one nobody is tracking: The average age of specialty shop owners in North America.

The Great Succession: The future of paddlesports retail

“You meet with a lot of retailers across the country and when you start to look at their ages, you have to ask what’s next,” says Katie Vinohradsky, a veteran outdoor sales rep based in Wisconsin. Recently, she came across an article profiling the top 100 retailers in a decade-old issue of the outdoor trade magazine SNEWS. “I went through that entire list and only about 60 percent of them are still around,” she says. “The other ones fell off.”

Many of those shops opened in the late 1970s through the 1980s, the golden age of specialty retail. In those days, a young paddling enthusiast could hang a shingle in a reasonably sized city and be the only place in that area where a person could buy a kayak or canoe. “Specialty was all there was,” says Rutabaga owner Darren Bush. “There were no box stores, no REI. You could make it work basically by opening a small store and being frugal.”

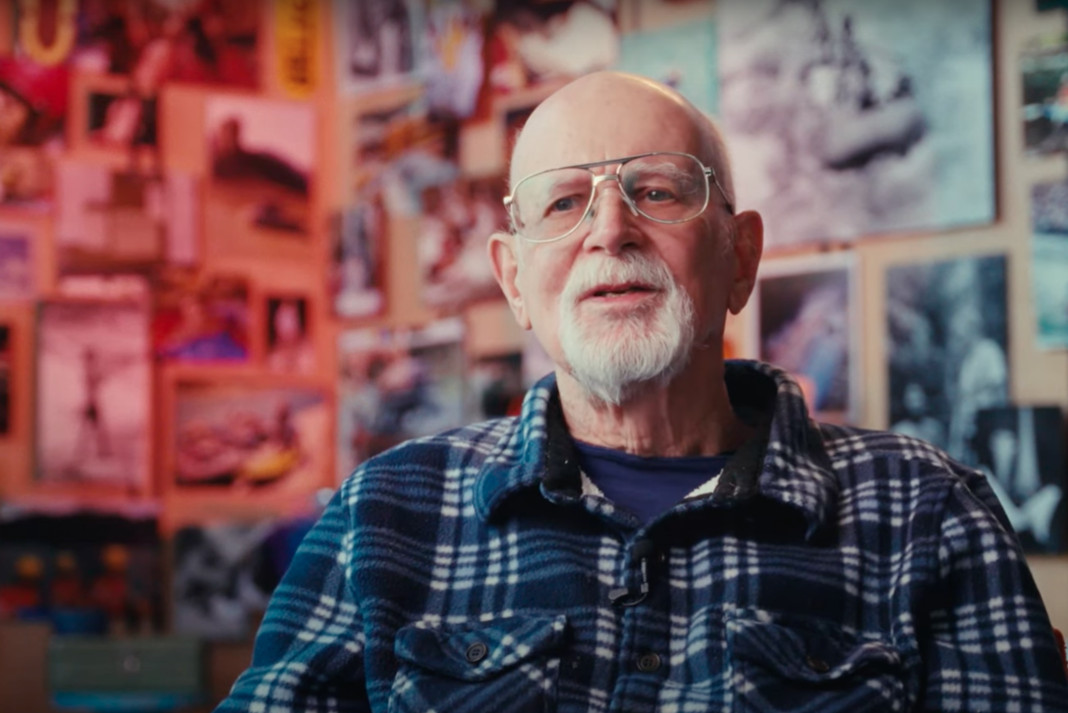

That scenario appealed to entrepreneurs motivated as much by their love of the sport as any hard-nosed business forecast. Take California Canoe & Kayak owner Keith Miller, who was deeply involved in the fight to save the Stanislaus River from damming when he started as a kayak guide. “The volunteer work I did to try to save the Stan shifted my life trajectory from banking to being a river runner,” says Miller, now 72. He had no illusions about his new career path. “From the get-go, I realized this can be a great lifestyle business, but you’re not going to make any money.”

Brian Henry made a similar calculation in 1981 when he opened Ocean River a few hundred miles up the coast in Victoria, B.C. “We didn’t know what the heck we were doing,” says Henry, 72. “We just got into it and it seemed so fun. It was a very exciting time, and I’m so fortunate we were one of the first ones involved in it.”

Specialty paddling shops were springing up all over North America in those years, founded by resourceful entrepreneurs with deep connections to the sport. They were the catalyst in the cosmic petri dish that gave us today’s paddlesports and the culture it lives in. But 40 years on, retail’s greatest generation is in their 60s and 70s, and that raises the question: What will become of the sport when they’re gone?

That’s something NRS marketing director Mark Deming has been giving a lot of thought to lately. “Every year when we do our SWOT analysis—strengths, weaknesses, opportunities and threats—the future of our dealer network as owners retire goes in the threat column,” says Deming.

Shop owners who shared their succession planning with Paddling Business were unanimous on one point. All would like to see their businesses pass to someone with the energy and acumen to guide them through an increasingly competitive business landscape. How they propose to get there is where it gets interesting.

“I think about a lot because you don’t just put a sign up saying ‘for sale’ and three months later it’s gone,” says Bush, 62. “It takes a year or two to prep for a transition, if you want to find a buyer who will do right by your business.” So far, Bush’s transition planning has been mostly hypothetical. He could have sold after the pandemic and funded a comfortable retirement, but chose instead to build a new store with 30 percent more retail space.

“If someone approached me with a check tomorrow, I’d say, ‘Okay, fine, but who are you, really?’ I’ve seen enough business transitions to know that while it will never be like it was, you don’t want your brand to be trashed by inept people. Because once the check clears, I don’t have any say.”

Passing the torch

One of the biggest hurdles is that few of the best candidates have the savings to buy in. According to a recent study by New York Life Insurance, neither Millennials (ages 31 to 43) nor Gen Xers (ages 44 to 59) are saving enough for retirement, let alone to acquire a retail business. Even more vexing than the amount of money retail managers and paddling guides have socked away are the other things they need it for, such as buying a home, having kids and paying down student loan debt. With interest rates holding steady at a 20-year high, the pool of qualified buyers is at a low ebb, while the number of shop owners reaching retirement continues to rise.

Even with years of prior planning, there’s no guarantee a store owner will find a suitable successor. Such was the case with Midwest Mountaineering’s Rod Johnson, who struggled to find a suitable candidate to take over the venerable Minneapolis paddling and outdoor store. In 2022, he took the search public, offering an $85,000 salary for a general manager who could eventually purchase the store. No takers. Johnson closed the doors in October 2023 after 53 years in business. “Midwest’s style of retailing is under intense pressure,” Johnson said in a release announcing the closure. “Big box and online shopping, including direct selling from manufacturers, is on a steady rise and continues to outpace traditional specialty stores like Midwest.”

Brian Henry’s Ocean River Sports followed a similar arc. Founded in 1981, the store nurtured a tight-knit community of paddlers on the southern end of Vancouver Island, eventually growing into an iconic 7,000-square-foot store in downtown Victoria. Even when Mountain Equipment Co-op (MEC) opened a franchise a few blocks away, Ocean River held its own.

“We survived for many, many years, but my vendors, who were all my friends in the beginning—Arc’teryx and all these guys—they got sold out to big international corporations who didn’t really care as much about the little guys,” Henry says. “I might have an Arc’teryx jacket that was a medium in blue, and a customer wanted a large. I could get it in five days, but the customer knew they could order it direct and have it in two.”

Henry says his store effectively became a warehouse and showcase for the big outdoor brands, and he saw it wasn’t sustainable. He closed the retail store in 2020 and doubled down on tours and instruction. He recently opened a smaller retail shop that fits comfortably in the gap chains like MEC can’t fill.

The store is doing well, Henry says, with new energy and strong leadership from retail and operations manager Jamie Dawson, who is back at Ocean River after a pandemic hiatus spent guiding in Haida Gwaii. Dawson is now a 25 percent shareholder in the company and one piece in an evolving succession plan. Henry is also exploring employee-ownership options, and his sons, Russell and Graham, have expressed interest. After establishing their own paddling bona fides, including a 4,000-mile trans-Caribbean epic from Brazil to Florida, the brothers have been campaigning in different realms, Russell as a whitewater and adventure guide and Graham as a lawyer.

Orchestrating a succession that involves Dawson, his sons and an employee ownership component is no easy task, but Henry is committed to making it work. “My wife thinks I just should walk away, but I can’t do that,” he says.

Keepers of the flame

Down the coast in California, Miller’s succession planning was multiplied by four—the number of California Canoe & Kayak locations he had at the end of 2020, including a whitewater school, land and retail outpost on the South Fork American, a store and lake rental concession in Rancho Cordova, and two rental and retail operations on San Francisco Bay. Rather than seek a single buyer, Miller’s succession involves a series of hand-picked heirs.

He sold his whitewater school on the South Fork American to Melissa DeMarie of California Watersports Collective in 2021, transferring the oldest kayak instruction permit on the river. In 2023 Miller sold the land to a local family that just opened Troublemakers Beer Garden on the property, named for one of the South Fork’s marquee rapids. The deal fulfilled a promise Miller made years ago to sell only to a South Fork local.

Miller passed his Redwood City location to David Wells, longtime co-owner of 101 Surf Sports in San Rafael, simply because he thinks Wells has what it takes to realize the location’s potential. Miller did everything in his power to ease the transition. “I sold David the containers, gave him some time to pay off the fixtures, and negotiated with our landlord to turn the lease over to him,” he says.

Miller orchestrated a similar transition for his store in Rancho Cordova, just outside Sacramento. An industry friend recommended Bryan Anondson, owner of Headwaters Adventure Company in Redding, as a potential successor. Miller then called another friend, Dan Arbuckle, to vet the choice.

“I said, ‘Dan, you know Bryan, is he a bright guy?’ And he said, ‘He’s the best,’” Miller recalls. “That’s all it took. I called Bryan and said, ‘Bryan, do you want my Rancho store?’ And within about a month, it was his.” Anondson assumed the lease and purchased the fixtures and some of the inventory in March 2023, Miller says. “The transition went seamlessly and leaves the local paddling community in great hands.”

In just over three years Miller divested three paddlesports operations and is actively exploring transition options for his flagship store at Jack London Square in Oakland. “We plan to exit this fall as best we can,” he says. “What that means is hard to tell.”

Miller’s experience shows that an expeditious transition is certainly possible—with the caveat, as Miller himself predicted all those years ago, that he didn’t make much money in the process. Whether that’s depressing or inspiring has a lot to do with one’s worldview and financial security. Miller has no regrets.

“I’ve done a lot of work over the years, but the people who’ve worked for me have done the work also,” says Miller, who credits the late NRS founder Bill Parks for sharpening his transition philosophy. A decade ago, at Outdoor Retailer, Miller asked for a few words of advice, and Parks spent an hour describing the employee stock option plan, or ESOP, he used to shift ownership of NRS to his employees in 2013.

Deming had been at NRS for about three years when Parks announced the plan. “He had been approached numerous times over the years by outside groups that wanted to invest or purchase the company, but Bill was never really about making money,” Deming recalls. “He drove a 10-year-old minivan, and if you saw him in the grocery store, he’d be wearing old blue jeans and sandals with socks.”

Though he may not have been motivated by money, Parks was good with it. He famously founded NRS as a side hustle to his tenured position as a business professor. After careful analysis, he settled on an ESOP as the best option to pass ownership to the people who helped him build NRS into a paddlesports powerhouse.

“This company was like his family, and he couldn’t bear the thought of having somebody else take it over and restructure it or run it into the ground,” Deming says. “At great personal risk, he helped finance a deal for the employees to take over all company stock.”

Every year, NRS employees with a year of service and 1,000 hours of work time in the past calendar year are eligible for a distribution of company stock. People at every level of the company take advantage of the plan, Deming says. “It’s very much changed the mentality of people coming to work every day. We’ve always been a company where employees bought in and did all they could for the business, but you think differently when you know you are the owner.”

Other large outdoor retailers have used ESOPs to transition to employee ownership, including the 500-plus employee Colorado outdoor chain JAX in 2022. Miller considered an ESOP, but the plan was too complex for a business the size of California Canoe & Kayak. His calculus has been weighted toward continuing the legacy he spent more than 45 years building.

“My whole driving force was to create new paddlers and create advocates for the environment,” Miller says. “That came directly from my Stanislaus River days, and that goal has never faded.”

Keith Miller at his flagship store in Oakland. | Feature photo: Courtesy California Canoe & Kayak

This article was first published in the 2024 issue of Paddling Business.

This article was first published in the 2024 issue of Paddling Business.