On February 28, 2025, Pelican International Inc filed a Notice of Intention to Make Proposal (NOI) under the Bankruptcy and Insolvency Act (BIA) in Canada, citing challenges in the post-COVID economy including U.S. tariffs, significant shifts in market demand, supply chain disruptions, and rising costs. In a company-issued statement, Pelican emphasized that this filing does not signal bankruptcy or closure but is instead a “proactive decision to seek protection under the BIA.”

Pelican declined further comment.

Insolvency refers to the state of being unable to meet debt obligations; insolvency does not necessarily lead to bankruptcy.

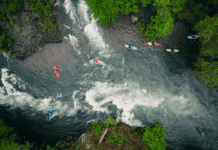

With US-Canada tariff disputes, Quebec-based Pelican seeks insolvency protection

Pelican stated the goal of initiating the BIA process is to allow the company time and a legal framework to adjust its finances for long-term stability. Pelican retains full control over its operations and daily affairs, according to the statement.

The filing comes after increasing uncertainty surrounding global trade policies, with fluctuating tariffs and trade disputes involving the U.S., Canada, Mexico and China. The market instabilities, combined with lingering supply chain disruptions following COVID-19, where paddlesports inventory peaked as demand began to drop, have contributed to financial pressures for manufacturers worldwide.

Currently, Pelican’s U.S. subsidiaries are not subject to the NOI proceedings, but Pelican noted it is evaluating whether to seek similar protection for US subsidiaries in the future.

In the statement, Pelican stated that it will not reduce its operations, and will “communicate any relevant updates directly with employees” regarding any positions eliminated as part of the restructuring process.

“We are committed to keeping all stakeholders informed throughout this process,” concluded the statement.

News comes after a recent push to expand

Initially founded in 1968 with a staff of 10 people, today Pelican’s portfolio includes Wilderness Systems, Dagger, Perception, Advanced Elements, Boardworks, Mad River Canoe, and GSI Outdoors.

In 1970, Pelican was purchased by Gérard Élie. In the years following, the first Pelican pedal boats, canoes, snowmobiles, sleds, and motor boats were produced using thermoformed plastic, a process where plastic is heated then formed into a mold popular in kayaks as a compromise between heavy polyethylene kayaks and lightweight composite kayaks.

In 1995, Pelican International Inc was acquired by Christian and Antoine Élie who had managed the company since 1979. Since 2001, Pelican’s head office has been located in Quebec, Canada.

Pelican has aggressively expanded in recent years. In 2019, Pelican acquired Confluence Outdoors Inc; in 2021 Pelican acquired Advanced Elements Inc, and in 2022 Pelican acquired GSI LCC.

The best thing for the world of paddling would be for both Pelican and Coleman to stop making watercraft! Those HDPE boats are pure garbage.

I 110% Agree

I’m not qualified to comment whether the material is the problem but the Pelican kayaks are um.. special. So many of them can’t even fit a skirt properly. Skirts are safety equipment imho. I had a Pelican Odyssey with no initial stability flopping to either 4 degrees port or starboard. How do you do that… and put it into production?! We really need some lightweight recreation kayaks that a woman, child or person with should health issues can still shoulder carry a few 100 feet

They are tough as hell, and are affordable, enabling more people to get out and enjoy the water. Garbage? I think not

Has nothing to do with Tarrifs. That happened a few weeks ago. You don’t go bankrupt in 3 weeks. Could it have been their carless spending when acquiring other companies that were not worth what they paid? Now they want the Canadian government to foot the bill for their stupidity and blame it on the US. DO BETTER Paddling Magazine! Horrible reporting!

Tariffs go into effect April 2nd, and there’s no way to say that a tariff doesn’t affect your financial forecasts. They got Confluence for a song, and in the process, kept open a South Carolina factory that was on the brink of closing down and wiping out all those American jobs. The Canadian government has nothing to do with “footing the bill” of any bankruptcy, any more than the US government stepped in to pay off any of Trump’s six bankruptcies (they didn’t – creditors are who take the bath, not the government, unless it was a government-guaranteed loan).

Paddle sport is not the only recreational industry that has problems adjusting to the post pandemic world.

Customers purchasing patterns changed significantly in the past 3 years with an overbuy during pandemic and high interest rates to follow.

The supply and demand timelines changed instantly. Companies were working with numbers not seen before.

Shit happens!!

Being in the company of a 5star rated paddler is very informative